4 Dec 2025

- 12 Comments

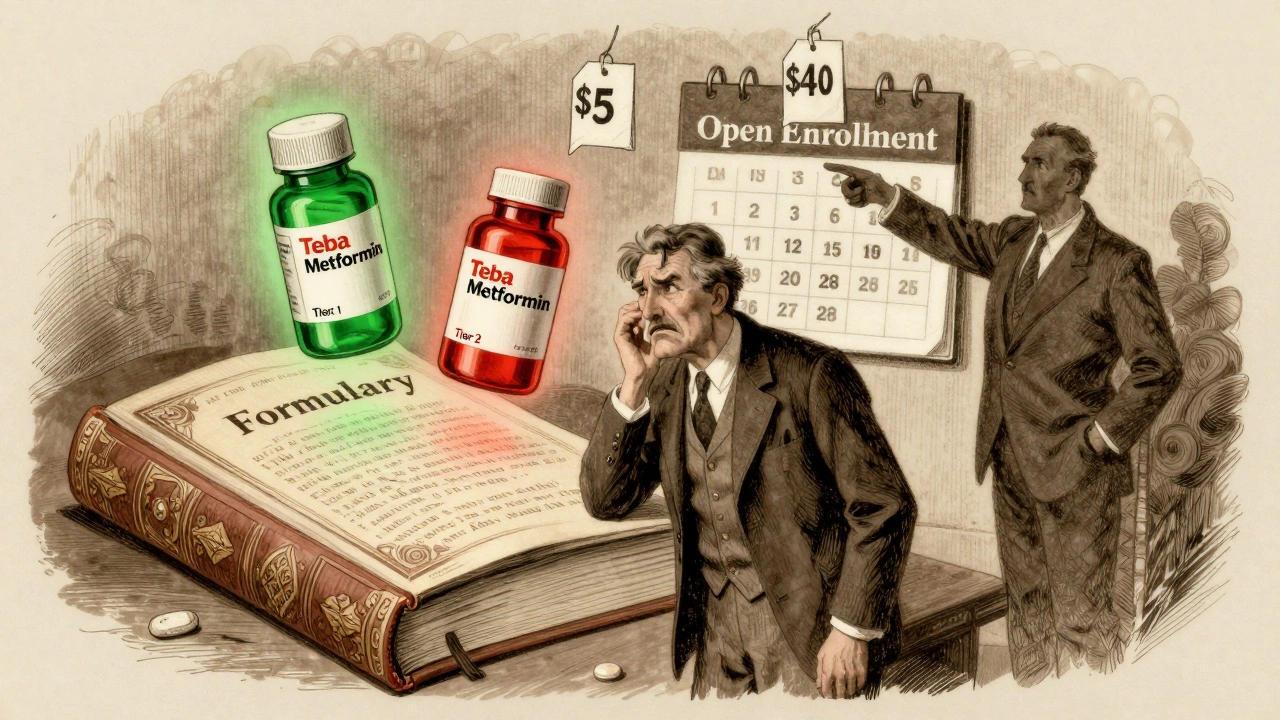

When you switch health plans, your monthly premium isn’t the only thing that changes. Your generic drug coverage might drop off completely - or cost you way more than you expected. Thousands of people find out the hard way that their $5 monthly metformin copay suddenly becomes a $40 coinsurance bill after switching plans. It’s not a glitch. It’s a formulary shift.

What Is a Formulary, and Why Does It Matter?

A formulary is your insurance plan’s list of covered drugs. It’s not just a catalog. It’s a pricing map. Drugs are grouped into tiers, and each tier has a different cost to you. Tier 1 is almost always generic drugs. Tier 2 is brand-name drugs with generic versions available. Tier 3 and 4 are more expensive brand-name or specialty drugs. The key? Not all generics are treated the same. Even if two pills have the same active ingredient - say, levothyroxine - one might be in Tier 1 (costing $3) and the other in Tier 2 (costing $35). Why? Because your insurer has a deal with one manufacturer and not the other. You don’t get to pick. Your plan does.How Generic Drug Tiers Work Across Plans

Most plans use 3 to 5 tiers. But the rules change depending on the type of plan you’re in.- Marketplace plans (ACA): Federal rules require a 4-tier structure. Tier 1 generics usually cost $3-$20 per 30-day supply. Silver Standardized Plan Design (SPD) plans go even further: they waive your deductible for Tier 1 generics. That means you pay $20, not $1,500.

- Medicare Part D: In 2025, the deductible will be $505, but most plans offer Tier 1 generics at $0-$10 after that. Some plans split generics into Tier 1 (preferred) and Tier 2 (non-preferred), so the same drug can cost twice as much.

- Employer plans: These vary wildly. One company might charge $5 for generics before you hit your deductible. Another might make you pay the full deductible first. MHBP Federal plans, for example, offer $5 copays for generics in their Basic Option - but $10 in their Consumer Option, only after the deductible.

- High-deductible health plans (HDHPs): These look cheap on paper - low premiums. But if you take daily meds, you could pay thousands before your coverage kicks in. Unless you’re in a Silver SPD plan, your generics won’t be covered until you’ve paid your full medical deductible.

State Rules Change Everything

Where you live can make a bigger difference than your plan choice.- In New York, many plans have $0 copays for generics - no deductible needed.

- In California, you pay an $85 outpatient drug deductible first, then 20% coinsurance - capped at $250 per year.

- In Washington, D.C., there’s a separate $350 drug deductible, with a $150 cap on specialty drugs.

What Happens When Your Generic Gets Moved

Your metformin might be in Tier 1 this year. Next year, it’s in Tier 2. Why? The manufacturer changed. Or your insurer switched suppliers. Or they decided to favor a different version. A 2023 Reddit analysis of 147 cases showed 63% of unexpected cost spikes came from generic drugs being moved to higher tiers - even though the active ingredient didn’t change. One user paid $0 for levothyroxine under Plan A. Under Plan B? 25% coinsurance. Same pill. Different price. This is why you can’t just check the drug name. You have to check the brand name of the generic. Metformin made by Teva? Covered. Metformin made by Mylan? Not on the formulary. Even though both are identical.How to Check Your Generic Coverage Before Switching

Don’t guess. Don’t rely on customer service. Do this:- Get the full formulary - not just the tier summary. Look for your exact drug name and manufacturer.

- Verify the strength. Is your 500mg metformin covered? What about 1000mg? They’re listed separately.

- Check your pharmacy network. Your $3 generic might cost $12 if you go to a non-preferred pharmacy. OptumRx data shows some people pay 300-400% more at out-of-network pharmacies.

- Calculate your annual cost. Multiply your monthly copay by 12. Add your deductible if it applies. Don’t forget mail-order discounts - sometimes 90-day supplies cost less than 30-day ones.

Tools That Actually Work

Use these tools - don’t just skim plan brochures.- Medicare Plan Finder (medicare.gov): Use the medication cost estimator. It’s accurate, free, and updated monthly. Over 4 million people used it in 2022.

- eHealthInsurance’s drug calculator: Processes 1.7 million queries a month. Lets you compare multiple plans side by side.

- Your insurer’s own formulary tool: Often the most accurate. Accuracy ranges from 78% on basic tools to 96% on insurer-specific ones.

Biggest Mistakes People Make

- Assuming all generics are equal. They’re not. The manufacturer matters.

- Ignoring the deductible. If your plan has a $2,000 medical deductible and integrates drug costs, you’ll pay full price for your pills until you hit that number.

- Not checking mail-order options. Some plans offer 90-day supplies for the price of 60. That’s a 30% savings.

- Waiting until open enrollment ends. You have 60 days after a life event (like losing a job) to switch. Don’t wait.

What’s Changing in 2025

The rules are shifting fast:- Medicare Part D will introduce a new Tier 1+ for non-preferred generics. Same drug. Higher cost.

- 2025 brings a $2,000 out-of-pocket cap for Medicare drug users - a big win for those on multiple meds.

- Insulin is capped at $35/month nationwide under the Inflation Reduction Act.

- Silver SPD plans are expanding to 32 states. More people will get deductible waivers for generics.

Bottom Line: Generic Coverage Can Save You Thousands

Generic drugs make up 90% of prescriptions but only 23% of drug spending. That’s because they’re cheap - if your plan covers them right. If you take even one daily generic medication - blood pressure, diabetes, thyroid - switching plans without checking coverage is like buying a new car without checking the gas mileage. You might think you’re saving on the sticker price, but you’ll pay more at the pump. Take 30 minutes before open enrollment. List your meds. Pull up the formulary. Compare the numbers. You could save $780 a year - or $5,000 if you’re on multiple drugs and avoid a high deductible. Don’t let formulary fine print cost you more than your premium.How do I know if my generic drug is covered by a new health plan?

You need to check the plan’s full formulary - not just the tier summary. Look up your exact drug name and the manufacturer (e.g., metformin by Teva vs. metformin by Mylan). Many plans list generics by brand name, even if they’re generic. Use the insurer’s official formulary search tool or Medicare Plan Finder for the most accurate results.

Why does my generic drug cost more on my new plan even though it’s the same medicine?

Because insurers negotiate deals with specific manufacturers. Even if two generics have the same active ingredient, one might be on Tier 1 (low cost) and the other on Tier 2 (higher cost) based on which company the plan has a contract with. It’s not about effectiveness - it’s about pricing agreements.

Do all health plans have the same tiers for generic drugs?

No. Marketplace plans must use a 4-tier system, but employer plans and Medicare Part D can use 3 to 5 tiers. Some plans split generics into preferred and non-preferred tiers. Medicare Advantage plans often have more complex structures than standalone Part D plans. Always check the specific plan’s formulary - don’t assume.

Should I avoid high-deductible health plans if I take daily generic medications?

If your plan integrates your drug deductible with your medical deductible, yes - unless you’re in a Silver Standardized Plan Design (SPD). Those waive the deductible for Tier 1 generics. Otherwise, you could pay hundreds or thousands out of pocket before your generic copay kicks in. For people on daily meds, a lower premium with a high deductible often ends up costing more.

Can I switch health plans mid-year if my generic drug gets dropped?

You can only switch outside open enrollment if you have a qualifying life event - like losing job-based coverage, moving to a new state, or getting married. If your plan just changes its formulary, that doesn’t count. But if your drug is removed entirely and you can’t afford the new cost, you may qualify for a Special Enrollment Period. Contact your state’s marketplace or Medicare directly to ask.

Are there any laws that protect me from sudden changes in generic drug coverage?

Federal law requires insurers to notify you at least 60 days before removing a drug from the formulary or changing its tier - unless it’s a safety issue. But if your drug stays on the list but moves to a higher tier, they don’t have to give you advance notice. That’s why checking your formulary every year during open enrollment is critical.

What’s the difference between a copay and coinsurance for generics?

A copay is a fixed amount you pay - like $5 or $15 - no matter what the drug costs. Coinsurance is a percentage - like 20% - of the drug’s total price. A $10 copay is predictable. A 20% coinsurance on a $100 generic could cost you $20. Most Tier 1 generics have copays. Higher tiers often use coinsurance, which can be much more expensive.

Mark Curry

December 5, 2025Just took 30 minutes to check my formulary. My levothyroxine went from $3 to $25. Same pill. Different manufacturer. I didn't even know that mattered.

Now I'm switching back to my old plan. Worth it.

Mellissa Landrum

December 6, 2025they dont want you to know this but the drug companies own the formularies. its all a scam. they push the expensive generics so you pay more and they get kickbacks. you think its about health? its about profit. the gov knows. they just dont care.

Jennifer Patrician

December 7, 2025you people are so naive. if you think your insurance cares about your meds you're living in a fantasy. they'll drop your $0 generic tomorrow if it means a 2% profit boost. i've seen it. i've fought it. they dont care if you go bankrupt. they care about quarterly reports.

Ali Bradshaw

December 9, 2025Good reminder to check formularies before switching. I used the Medicare Plan Finder last year and saved $800 on my diabetes meds. Took 20 minutes. Best 20 minutes of the year.

Don't skip this step. It's not boring-it's life-changing.

Laura Saye

December 10, 2025There's a structural asymmetry in how formularies are designed-pharmaceutical manufacturers hold disproportionate leverage through rebate structures, which incentivize tier placement over therapeutic equivalence.

Consequently, patient outcomes are suboptimized under the guise of cost containment, creating what I'd term a 'therapeutic misalignment economy.'

It's not just about copays-it's about systemic misalignment between clinical need and financial architecture.

Michael Dioso

December 12, 2025so you mean to tell me the same pill costs more because of who made it?

wow. what a surprise. next you'll tell me water is wet.

we're all just pawns in a corporate game and we're still surprised when we get stabbed in the back.

thanks for the recap, captain obvious.

luke newton

December 13, 2025People who don't check their formularies are just asking to get robbed. You think you're saving on premiums? You're just trading one kind of pain for another.

It's not hard. Five minutes. One search. No excuse. Stop being lazy and take responsibility.

And if you're on Medicare, you're basically begging for a scam. The system is rigged.

Philip Kristy Wijaya

December 14, 2025One must consider the ontological implications of pharmaceutical tiering within the neoliberal healthcare apparatus. The arbitrary distinction between Teva and Mylan metformin is not a clinical differentiation but a semiotic construct designed to obscure the commodification of biological necessity.

One pays not for efficacy but for corporate affiliation.

One is not a patient but a consumer in a market where health is a privilege, not a right.

The formulary is the new social contract.

And we signed it without reading.

And now we wonder why we are dying of diabetes while CEOs buy yachts.

Perhaps the real question is not how to navigate the system but whether to dismantle it entirely.

Manish Shankar

December 14, 2025Thank you for this comprehensive guide. In India, generic drugs are heavily regulated and priced by the government, so cost differences between manufacturers are minimal. However, the principle of verifying formularies before switching plans is universal.

Patients everywhere must be empowered with knowledge. Thank you for highlighting the importance of checking manufacturer names and pharmacy networks.

Such clarity is rare and deeply appreciated.

Krishan Patel

December 16, 2025You're all missing the point. The real problem isn't the formulary. It's that you're trusting corporations to care about your life. You think checking a website will save you? You're still playing their game.

Real change comes from refusing to participate. Stop buying into the illusion of choice. The system is designed to extract. No amount of formulary research changes that.

Join a union. Demand single-payer. Or keep checking tiers and pretending you have control.

sean whitfield

December 18, 2025so i paid $20 for my blood pressure med last year

now it's $80

same pill

same doctor

same me

but now i'm a 'tier 2 liability'

brilliant

who came up with this genius system

oh right

the same people who think 'wellness' is a $12 smoothie

and healthcare is a subscription service

thanks for the reminder that capitalism has no soul

Carole Nkosi

December 18, 2025It's not about the drug. It's about control. The system wants you dependent. It wants you confused. It wants you paying more so you stay silent.

They don't want you to know that generics are identical. They want you to think there's a difference.

That's not business. That's manipulation.

And we're all complicit because we're too tired to fight.

But I'm not. I'm checking every formulary. Every year. No more silence.